The Role of Crypto in the Future of Finance

Cryptocurrency has grown from a niche technology into a major player in the global economy. What began as a digital alternative to money is now shaping how people save, invest, and transfer funds. With innovations like decentralized finance and central bank digital currencies, it is clear that crypto will play a huge role in the future of finance.

Decentralized Finance (DeFi)

One of the most exciting developments is decentralized finance, or DeFi. This is a financial system built on blockchain technology that allows people to borrow, lend, and earn interest without banks. Platforms like Uniswap, Aave, and Compound are examples of DeFi applications where users interact directly with smart contracts.

DeFi reduces costs, removes middlemen, and offers services to anyone with internet access. For people in countries with weak banking systems, DeFi could provide financial opportunities that were never possible before.

Cross-Border Payments

Sending money across borders has always been slow and expensive with traditional banks. Cryptocurrency changes that by enabling instant global transfers with minimal fees. Ripple, for example, is designed specifically to make international transactions faster and cheaper. This makes crypto especially attractive for migrant workers sending remittances home.

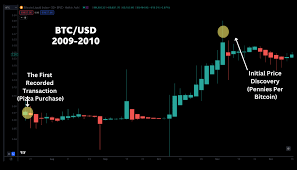

Store of Value and Hedge Against Inflation

Another role of cryptocurrency, especially Bitcoin, is to act as a store of value. With a limited supply of 21 million coins, Bitcoin is often compared to digital gold. In countries where inflation is high, many people turn to Bitcoin or stablecoins like USDT to protect their savings. As central banks continue printing money, cryptocurrencies provide an alternative that cannot be easily devalued.

Central Bank Digital Currencies (CBDCs)

Governments are also paying attention to the rise of cryptocurrency. Many are developing their own digital versions of national currencies, known as central bank digital currencies. China’s digital yuan is one of the most advanced examples. CBDCs aim to combine the benefits of digital payments with government-backed stability. While they are different from decentralized cryptocurrencies, their creation shows how crypto is influencing global finance.

Challenges to Overcome

For cryptocurrency to fully integrate into the future of finance, it must overcome several challenges. Price volatility is a major issue, making it difficult to use crypto as everyday money. Regulatory uncertainty also creates risks for both investors and businesses. Additionally, the environmental impact of energy-intensive mining methods remains a global concern.

Conclusion

Cryptocurrency is no longer just an experimental form of money. It is shaping the financial world by enabling decentralized finance, improving cross-border payments, and acting as a store of value. With governments exploring digital currencies and businesses adopting blockchain solutions, crypto is set to remain a powerful force in the future of finance. The road ahead may have challenges, but the potential for innovation is enormous.